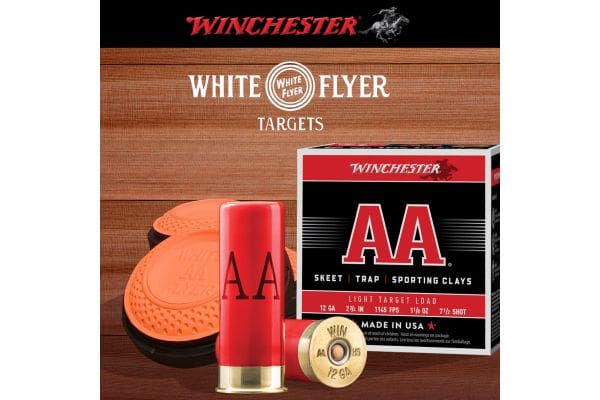

Olin – Winchester Acquires White Flyer Targets Business

Olin Corporation (NYSE: OLN) announced today that it has completed the previously announced acquisition of White Flyer Targets, North America’s preeminent leader in recreational trap, skeet, and sporting clay targets. White Flyer will be combined with the Winchester Ammunition business.

The acquisition includes White Flyer’s five state of the art manufacturing facilities in Coal Township, Pennsylvania; Dalton, Georgia; Webb City, Missouri; Knox, Indiana; and, San Bernardino, California and includes White Flyer’s recently announced ECO FLYER® target product line.

“We welcome our new White Flyer teammates,” noted Brett Flaugher, president of Winchester Ammunition. “Together, we can enhance the continued growth of trap, skeet, sporting clays, and other shotgun sports. These two leading brands are renowned for unmatched quality and now offer increased value to our customers through comprehensive ammunition and clay target solutions for the thousands of shooting ranges across America.”

Olin funded the transaction with cash on hand and anticipates that the transaction will be immediately accretive to Olin’s shareholders.

OLIN COMPANY DESCRIPTION

Olin Corporation is a leading vertically-integrated global manufacturer and distributor of chemical products and a leading U.S. manufacturer of ammunition. The chemical products produced include chlorine and caustic soda, vinyls, epoxies, chlorinated organics, bleach, hydrogen, and hydrochloric acid. Winchester’s principal manufacturing facilities produce and distribute sporting ammunition, law enforcement ammunition, reloading components, small caliber military ammunition and components, and industrial cartridges.

Visit www.olin.com for more information on Olin.

FORWARD-LOOKING STATEMENTS

This communication includes forward-looking statements. These statements relate to analyses and other information that are based on management’s beliefs, certain assumptions made by management, forecasts of future results, and current expectations, estimates and projections about the markets and economy in which we and our various segments operate. The statements contained in this communication that are not statements of historical fact may include forward-looking statements that involve a number of risks and uncertainties.

We have used the words “anticipate,” “intend,” “may,” “expect,” “believe,” “should,” “plan,” “outlook,” “project,” “estimate,” “forecast,” “optimistic,” “target,” and variations of such words and similar expressions in this communication to identify such forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding the Company’s intent to repurchase, from time to time, the Company’s common stock. These statements are not guarantees of future performance and involve certain risks, uncertainties, and assumptions, which are difficult to predict and many of which are beyond our control. Therefore, actual outcomes and results may differ materially from those matters expressed or implied in such forward-looking statements. We undertake no obligation to update publicly any forward-looking statements, whether as a result of future events, new information or otherwise. The payment of cash dividends is subject to the discretion of our board of directors and will be determined in light of then-current conditions, including our earnings, our operations, our financial conditions, our capital requirements and other factors deemed relevant by our board of directors. In the future, our board of directors may change our dividend policy, including the frequency or amount of any dividend, in light of then-existing conditions.

The risks, uncertainties and assumptions involved in our forward-looking statements, many of which are discussed in more detail in our filings with the SEC, including without limitation the “Risk Factors” section of our Annual Report on Form 10-K for the year ended December 31, 2022, and our Quarterly Reports on Form 10-Q and other reports furnished or filed with the SEC, include, but are not limited to, the following:

Business, Industry and Operational Risks

sensitivity to economic, business and market conditions in the United States and overseas, including economic instability or a downturn in the sectors served by us;

declines in average selling prices for our products and the supply/demand balance for our products, including the impact of excess industry capacity or an imbalance in demand for our chlor alkali products;

unsuccessful execution of our strategic operating model, which prioritizes Electrochemical Unit (ECU) margins over sales volumes;

failure to control costs and inflation impacts or failure to achieve targeted cost reductions;

our reliance on a limited number of suppliers for specified feedstock and services and our reliance on third-party transportation;

the occurrence of unexpected manufacturing interruptions and outages, including those occurring as a result of labor disruptions, production hazards and weather-related events;

availability of and/or higher-than-expected costs of raw material, energy, transportation, and/or logistics;

the failure or an interruption of our information technology systems;

failure to identify, attract, develop, retain and motivate qualified employees throughout the organization;

our inability to complete future acquisitions or joint venture transactions or successfully integrate them into our business;

risks associated with our international sales and operations, including economic, political or regulatory changes;

the negative impact from a public health crisis, such as a pandemic, epidemic or outbreak of infectious disease, including the COVID-19 pandemic and the global response to the pandemic, including without limitation adverse impacts in complying with governmental mandates;

our indebtedness and debt service obligations;

weak industry conditions affecting our ability to comply with the financial maintenance covenants in our senior credit facility;

adverse conditions in the credit and capital markets, limiting or preventing our ability to borrow or raise capital;

the effects of any declines in global equity markets on asset values and any declines in interest rates or other significant assumptions used to value the liabilities in, and funding of, our pension plans;

our long-range plan assumptions not being realized causing a non-cash impairment charge of long-lived assets;

Legal, Environmental and Regulatory Risks

changes in, or failure to comply with, legislation or government regulations or policies, including changes regarding our ability to manufacture or use certain products and changes within the international markets in which we operate;

new regulations or public policy changes regarding the transportation of hazardous chemicals and the security of chemical manufacturing facilities;

unexpected outcomes from legal or regulatory claims and proceedings;

costs and other expenditures in excess of those projected for environmental investigation and remediation or other legal proceedings;

various risks associated with our Lake City U.S. Army Ammunition Plant contract and performance under other governmental contracts; and

failure to effectively manage environmental, social and governance (ESG) issues and related regulations, including climate change and sustainability.

All of our forward-looking statements should be considered in light of these factors. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of our forward-looking statements.

The post Olin – Winchester Acquires White Flyer Targets Business appeared first on HuntingLife.com.